CalSavers is designed to make facilitating a retirement program easy for small businesses. Registration is now open and required by state law for employers who do not offer a qualified retirement plan. Be sure to register or apply for exemption by December 31, 2025.

Additionally, you will have more opportunities to attend webinars, ask questions, and talk to field representatives in your region. The sooner you register, the sooner your employees can start saving and the more support will be available to you during the registration process. It only takes 15 minutes to get started.

You may be exempt if your company:

1 Employer eligibility and mandate status is based on an employer’s average number of employees from the previous year. This number is calculated by averaging the number of employees reported to EDD on an employer’s four DE9/DE9C filings from the prior calendar year.

Simply complete an exemption form. You will need your:

1 Employer eligibility and mandate status is based on an employer’s average number of employees from the previous year. This number is calculated by averaging the number of employees reported to EDD on an employer’s four DE9/DE9C filings from the prior calendar year.

Follow these four simple steps to get started and manage your program.

After completing your registration, you'll receive a confirmation email outlining your next steps.

Tip: If you have an employee or third-party you can add them as an administrator to help manage your company's account.

Employees will receive an invitation to set up their account and will have 30 days to opt out. If no action is taken, they will be automatically enrolled.

The first contribution submission will be the first pay date that occurs 30 days after you upload your employee roster. You'll get a reminder when it's time. The CalSavers client service team can help you set up CalSavers in your payroll system.

Contributions must be sent within seven days of taking money out of employees' paychecks.

After completing your registration, you'll receive a confirmation email outlining your next steps.

Tip: If you have an employee or third-party you can add them as an administrator to help manage your company's account.

Employees will receive an invitation to set up their account and will have 30 days to opt out. If no action is taken, they will be automatically enrolled.

The first contribution submission will be the first pay date that occurs 30 days after you upload your employee roster. You'll get a reminder when it's time. The CalSavers client service team can help you set up CalSavers in your payroll system.

Contributions must be sent within 7 days of taking money out of employees' paychecks.

Employer assistance: 855-650-6916

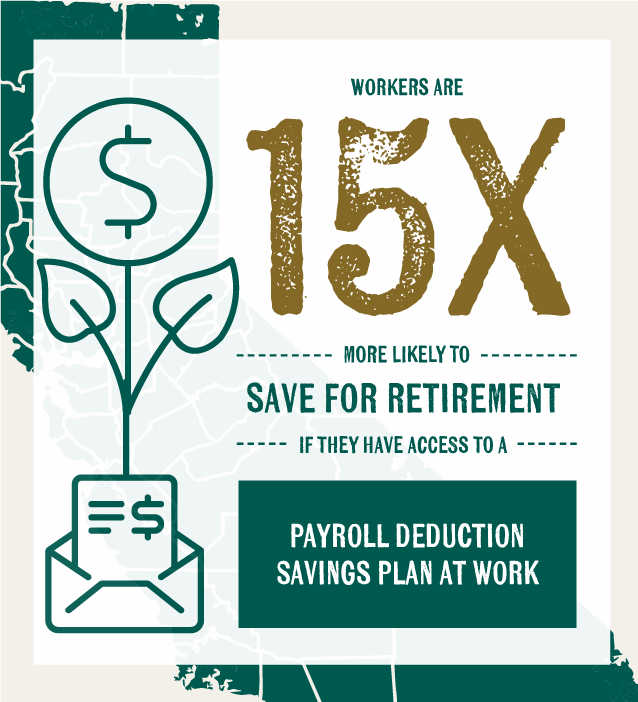

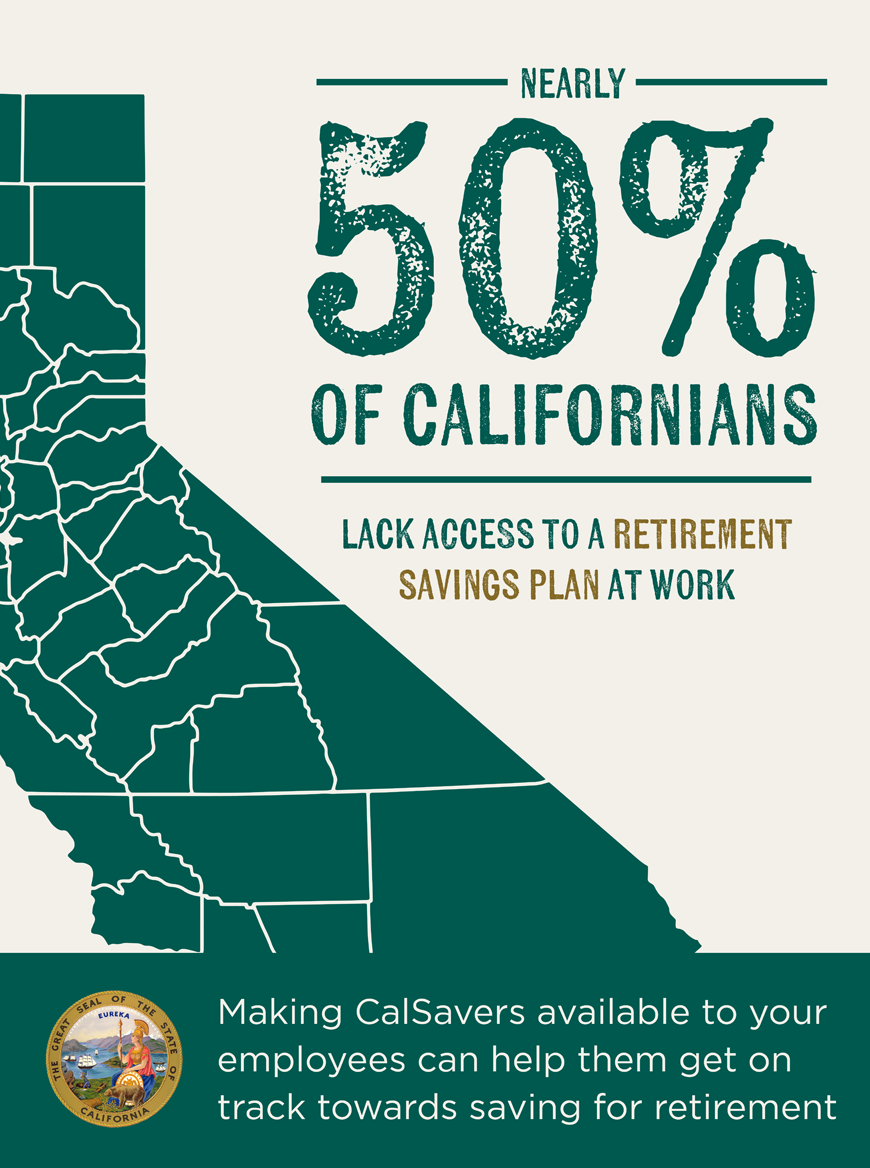

CalSavers is a state-facilitated retirement savings program that helps employees save for retirement through automatic payroll deductions into an Individual Retirement Account (IRA). The California Legislature created CalSavers so that all Californians have an easy way to save for their future. Research shows that employees are 15 times more likely to save money and put themselves on a path toward retirement security if they have access to a payroll deduction savings program at work. CalSavers helps employees save money automatically from their paychecks, which increases their likelihood of saving for retirement.

All California employers with one or more employees that do not offer a qualified retirement plan, and are not otherwise exempt, must facilitate CalSavers.

You may be exempt from the mandate if your company:

If you are exempt from the mandate, to confirm your exemption. You will need your Federal Employer Identification Number (FEIN), California payroll tax ID number from the Employment Development Department (EDD), and the CalSavers access code from your notice.

To comply with the CalSavers mandate, you must:

CalSavers has resources and support available to assist employers during their onboarding process. Visit the employer resources and employer support webpages for additional FAQs, documents, templates, webinars, and to request client support or one-on-one assistance.

Webinars are available in multiple languages every week for you and your employees.

Meet with a field representative in your area to discuss the program, receive guidance setting up your account, and get answers to your questions.